Today, SALI is pleased to announce that we have joined the United Nations Global Compact initiative : a voluntary initiative for the development, implementation, and disclosure of responsible business practices.

With this announcement, SALI is proud to join the network of global companies committed to taking responsible business action to create the world we all want. The UN Global Compact is a call to companies everywhere to align their operations and strategies with ten universally accepted principles in the areas of human rights, labour, environment, and anti-corruption, and to take action in support of Sustainable Development Goals (SDGs).

Launched in 2000, the UN Global Compact is the largest corporate sustainability initiative in the world, with more than 20,000 companies based in over 160 countries, and more than 60 Global Compact Networks.

“In line with our commitment to these principles, SALI Technologies is proud to join the UN Global Compact as a demonstration of our dedication to responsible business, ethical innovation, and data-driven sustainability leadership. We pledge to actively protect our environment and lead with integrity across industries. Our mission remains clear: to deliver the trust, traceability, and transparency that move organisations from insights to assurance,” noted Dr Eberechi Weli, Chief Executive Officer, SALI Technologies.

As a participant of the initiative, we encourage you to visit our profile on the UN Global Compact website and learn more about our latest work in sustainability benchmarking, reporting, and compliance.

Tag: Sustainability

-

SALI Technologies Joins UN Global Compact, Strengthening Commitment to Ethical Innovation and Sustainability

-

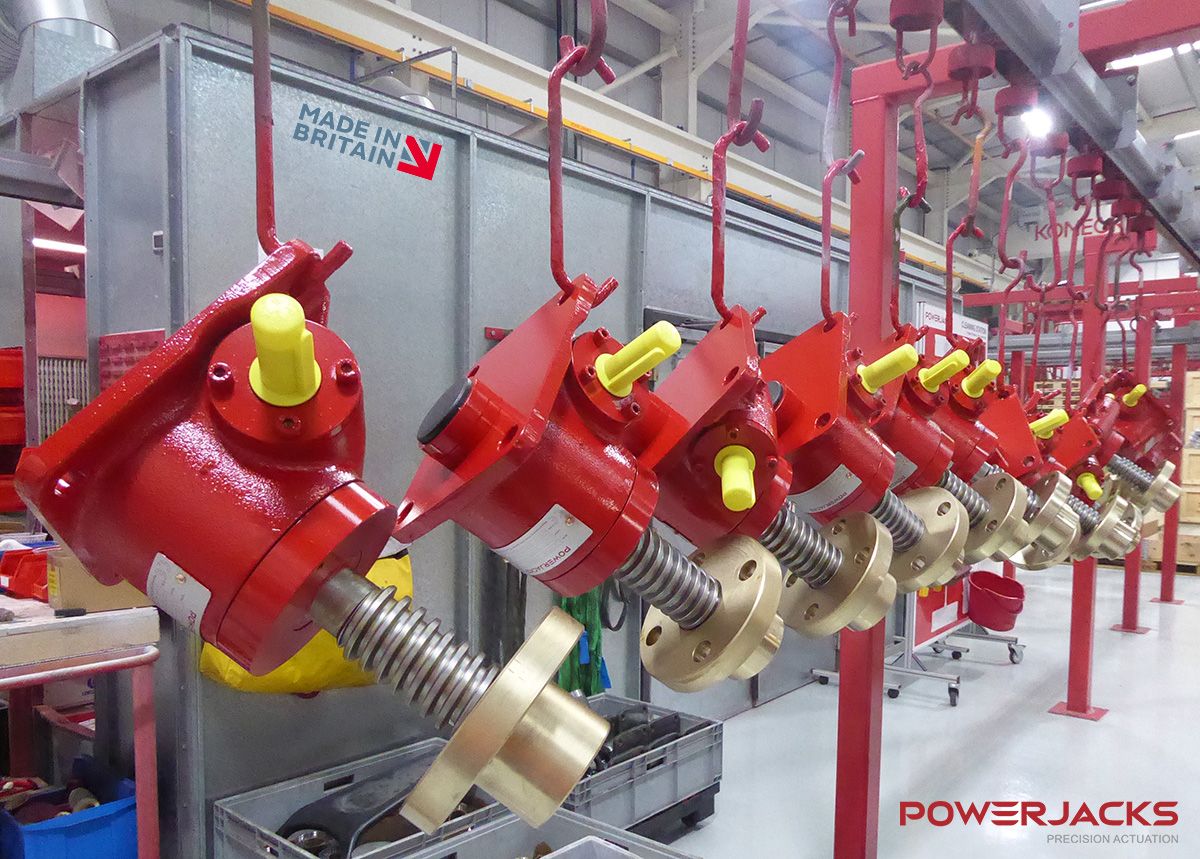

PowerJacks Onboards to SALI Platform to Accelerate Sustainability Compliance

ABERDEEN, SCOTLAND — British engineering firm PowerJacks has joined forces with sustainability compliance platform SALI, in a major step toward digitising its environmental reporting and aligning with international sustainability standards.

The move brings PowerJacks, a global provider of electro-mechanical actuation and lifting solutions onto the AI-powered SALI platform to streamline sustainability data management, reduce compliance risk and reinforce environmental accountability. With the partnership now in place, PowerJacks has begun its formal onboarding with SALI — integrating systems, training staff, and deploying customised sustainability modules to ensure a seamless transition.

Founded in Aberdeenshire and operating in more than 80 countries, PowerJacks has long been recognised for its precision-engineered products used in sectors ranging from energy to defence. Now, the company is expanding its focus beyond mechanical innovation to include measurable sustainability performance.

The SALI platform, known for its AI-driven compliance assessments and evidence-backed sustainability reporting, enables organisations to meet rapidly evolving regulations such as the Corporate Sustainability Reporting Directive (CSRD), GRI, ISSB, and UN SDGs. With tailored industry modules, SALI validates uploaded documents, scores their quality and generates improvement insights in real time.

Strategic Shift to Digital Assurance

PowerJacks’ integration with SALI allows for automated tracking of key sustainability metrics, including energy usage, waste management, air emissions, and circularity. The company will also benefit from AI-generated scenario modelling and lifecycle assessments, ensuring that operational efficiency is matched by environmental foresight.

The partnership is especially notable given PowerJacks’ deep industrial footprint and long-standing reputation for engineering reliability. With over 60 skilled employees and five core product categories, from screw jacks to jacking systems, the company’s pivot towards ESG alignment signals a broader industry shift.

Part of a Growing Trend

PowerJacks joins a growing list of industrial and manufacturing companies choosing SALI to help them bridge the gap between technical operations and sustainability expectations.

SALI’s framework is designed to adapt across business sizes and sectors, beginning with local codes of practice and scaling up to international reporting frameworks. The platform provides full audit trails, document-backed evidence and sector-specific benchmarks, helping organisations demonstrate true compliance rather than self-declared claims.

“As pressure mounts from regulators, investors, and stakeholders alike, this level of transparent and verifiable reporting has become essential, instead of optional. I applaud PowerJacks’ commitment to quality, and this is reflected in how they are managing their environmental impact,” said SALI’s Chief Executive Officer, Dr. Eberechi Weli.

Building the Future with Evidence

PowerJacks’ decision to partner with SALI reflects a growing corporate awareness that sustainability is a measurable standard of business performance.

The move is expected to enhance stakeholder confidence, reduce operational overhead tied to manual reporting, and position PowerJacks as a frontrunner in sustainable industrial practices.

-

SALI at Innovation Zero: Setting the Standard for High-Quality Sustainability Reporting

Tomorrow, SALI-AI Technologies takes the stage twice at Innovation Zero, joining a global lineup of leaders committed to building a sustainable future through practical, data-powered solutions.

From the materials that fuel our infrastructure to the disclosures that define accountability, the transition to a sustainable economy demands better systems, smarter tools, and credible leadership. At Innovation Zero, the UK’s leading platform for sustainability innovation, SALI is proud to contribute to that transformation — twice in one day.

Session One: 10:45AM

Title: Making Circularity a Business Reality: Data-Driven Decisions for Long-Term Benefits

Speakers:- Amy Dickinson – ESG Director, Europe & Africa, Egis

- Dr. Eberechi Weli – CEO, SALI Technologies

In this session, we’ll explore how SALI is working with infrastructure giant Egis to integrate AI-powered sustainability tools into major transport and healthcare projects. The goal? Turn circularity into real, measurable business value.

This isn’t theory — it’s about leveraging live project data to optimize materials, improve resource efficiency, and future-proof infrastructure delivery models. If you’re looking to transform sustainability ambitions into operational results, this session will show how SALI helps make that possible.

Session Two: 3:45PM

Title: Criteria for Quality Reporting and Integrating Sustainability into Business Reporting & Practices

Speakers:- Elena Botvina – Sustainable Finance, United Nations Conference on Trade and Development (UNCTAD)

- Dr. Eberechi Weli – CEO, SALI Technologies

Later in the afternoon, SALI will join forces with UNCTAD to explore how global policy guidance is being translated into real tools that companies can use today. This session focuses on high-quality sustainability disclosures — what they look like, why they matter, and how SALI is supporting companies to align with SDG Indicator 12.6.1 through innovation and data integrity.

We’ll also reveal insights into a centralized reporting platform currently in development — an ecosystem designed to help businesses streamline reporting, collaborate across sectors, and deliver disclosures that stand up to global scrutiny.

Why These Sessions Matter

These aren’t panel discussions for the sake of awareness. They are working sessions that reflect SALI’s core belief: sustainability must be integrated, measurable, and actionable.

Whether helping engineering firms rethink circular resource use or helping companies strengthen their ESG disclosures, SALI is doing the critical systems work that bridges intention with implementation.

If you’re attending Innovation Zero, join us to discover how SALI is shaping the new frontier of sustainability — not with trends, but with tools.

—

Follow the conversation live on LinkedIn and Twitter via #InnovationZero2025 and #SALIimpact.For press or partnership inquiries, contact: info@sali-ai.com

-

Retail and Consumer Goods: Balancing Profitability with ESG Commitments in the UK and Europe

In 2025, the retail and consumer goods sectors in the UK and Europe are navigating a pivotal crossroads. While profitability remains a top priority, Environmental, Social, and Governance (ESG) commitments are increasingly influencing business strategies. Consumers, investors, and regulators are placing heightened emphasis on sustainability, ethical practices, and transparent governance.

The ESG Imperative: Consumer Expectations and Regulatory Pressures

Consumer demand for ethically produced and environmentally friendly products continues to rise. Research indicates that 46% of UK Millennials are willing to pay more for sustainably produced goods, and 47% prefer products with eco-friendly packaging. Simultaneously, the European Union is advancing regulations such as the Corporate Sustainability Reporting Directive and the EU Taxonomy Regulation, which mandate comprehensive ESG disclosures.

Profitability Challenges Amid ESG Integration

Retailers are encountering challenges in aligning ESG initiatives with profitability. For instance, Sainsbury’s anticipates flat profits due to intensified competition and rising operational costs, despite investing £1 billion over four years to support customers. Similarly, B&M European Value Retail’s UK sales declined, though strong performance in France and new store openings provided some offset.

Moreover, companies are facing increased costs associated with compliance to ESG regulations. A report by DLA Piper highlights that only 13% of companies have completed the necessary sustainability assessments, indicating a significant gap in preparedness.

Strategic Approaches to Harmonize Profitability and ESG Goals

To effectively balance profitability with ESG commitments, retailers can adopt the following strategies:

- Sustainable Supply Chains: Engage with suppliers to ensure ethical sourcing and reduce environmental impact. This includes sharing sustainability data and forming exclusive agreements with sustainable suppliers.

- Circular Economy Initiatives: Implement programs that promote product reuse and recycling. For example, fashion brands are launching resale platforms to encourage circular consumption.

- Transparency and Reporting: Enhance ESG disclosures to build consumer and investor trust. Regular and clear reporting on ESG metrics can differentiate brands in a competitive market.

- Consumer Engagement: Educate and involve consumers in sustainability efforts. Brands that actively engage with their customers on ESG matters tend to foster loyalty and drive sales .

Conclusion

The convergence of profitability and ESG commitments presents both challenges and opportunities for the retail and consumer goods sectors in the UK and Europe. By strategically integrating sustainability into their operations and aligning with consumer values, companies can not only enhance their profitability but also contribute positively to societal and environmental well-being.

-

Sustainability Reporting in the Financial Sector: Key Challenges and Best Practices

Estimated Reading Time: 6 minutes

Why Sustainability Reporting is Mission-Critical for Financial Institutions

In the UK and across Europe, sustainability reporting in the financial sector is no longer a value-added exercise—it is an operational necessity. Driven by tightening regulations, rising stakeholder scrutiny, and the urgent need to finance the green transition, financial institutions are now on the front lines of the ESG revolution.

Sustainability reporting acts as a mirror of institutional priorities and preparedness. It reflects how banks, asset managers, and insurers navigate climate risk, support decarbonisation, and align capital with long-term societal value. But while expectations are high, the path to high-quality ESG disclosure is anything but straightforward.

Key Challenges Facing Financial Institutions

Despite a clear mandate, UK and EU-based financial institutions continue to encounter significant challenges when embedding sustainability into reporting practices.

1. Regulatory Complexity and Evolving Standards

From the EU Sustainable Finance Disclosure Regulation (SFDR) to the UK’s TCFD-aligned disclosure requirements, institutions face a fast-evolving landscape. Navigating overlapping mandates—especially in multi-jurisdictional operations—creates reporting fatigue and compliance risks.

Did you know? As of 2024, the UK government is transitioning toward mandatory reporting based on IFRS S1 and S2, marking a shift from voluntary to uniform climate-related disclosure.

2. Operationalising Double Materiality

Under the EU Corporate Sustainability Reporting Directive (CSRD), companies must assess not only how sustainability issues affect them (financial materiality) but also how they impact people and the planet (impact materiality). Implementing this “double materiality” lens requires robust systems and new KPIs—many of which are still being defined.

3. Financed Emissions and Scope 3 Complexity

Financial institutions bear indirect emissions through the assets they finance. However, calculating Scope 3 emissions—especially for SME clients or private assets—remains a persistent data blind spot.

4. ESG Data Fragmentation

Third-party ESG ratings and data providers often use divergent methodologies. This undermines comparability and can lead to conflicting assessments, frustrating both reporters and investors.

5. Risk of Greenwashing and Regulatory Backlash

As regulators crack down on misleading ESG claims, poorly substantiated disclosures now carry significant legal and reputational risks. The UK Financial Conduct Authority (FCA) has strengthened its stance on greenwashing, particularly under its proposed Sustainability Disclosure Requirements (SDR).

Best Practices for ESG Disclosure in the Financial Sector

Amid this complexity, leading institutions are redefining ESG reporting—not as a compliance burden, but as a strategic advantage.

1. Align with ISSB and EFRAG for Global-Local Consistency

For pan-European institutions, aligning with IFRS S1/S2 (ISSB) provides a global baseline. Meanwhile, the European Financial Reporting Advisory Group (EFRAG) standards ensure alignment with CSRD and EU taxonomy expectations.

Tip: Develop a reporting roadmap that integrates both ISSB and CSRD-aligned standards, with clearly defined internal roles.

2. Integrate ESG into Core Risk and Finance Functions

Move beyond standalone sustainability reports. Leading banks are embedding climate risk into credit decision-making, stress testing, and capital allocation. ESG metrics are being treated with the same rigour as financial data.

3. Enhance ESG Data Governance and Traceability

Invest in digital ESG platforms that improve auditability, traceability, and comparability of sustainability metrics. Open-source initiatives like PACTA (Paris Agreement Capital Transition Assessment) can also help align portfolios with net zero.

4. Use Scenario Analysis to Inform Strategy

Forward-looking disclosures, especially under TCFD/IFRS S2, require scenario-based climate risk analysis. Institutions should model multiple climate trajectories (e.g., 1.5°C, 2°C) and disclose strategic implications for key sectors.

5. Report on Real-World Outcomes, Not Just Policies

Stakeholders want transparency on how ESG strategies are transforming the real economy. This includes reporting on:

- Gender diversity in board appointments

- Investment in clean energy infrastructure

- Exposure to fossil fuels

- Just transition support for vulnerable communities

SALI Note: Impact-based reporting builds long-term stakeholder trust and positions institutions as ESG leaders in a post-greenwashing era.

UK and EU Regulatory Outlook: What’s Ahead

Financial institutions must stay ahead of rapidly evolving disclosure rules. Here’s what to watch:

Regulation Description Applicability IFRS S1/S2 (UK Sustainability Reporting Standards) Global baseline standards for sustainability and climate disclosures, developed by the ISSB. The UK government is finalizing the endorsement of IFRS S1 and S2, with the aim to publish UK Sustainability Reporting Standards (UK SRS) in Q1 2025. Subject to consultation, mandatory reporting is expected to commence for periods beginning on or after January 1, 2026. TCFD (Task Force on Climate-related Financial Disclosures) Framework for disclosing climate-related financial risks and opportunities. Mandatory for premium-listed companies in the UK since 2022. With the upcoming adoption of IFRS S2, which builds upon TCFD recommendations, existing TCFD disclosures will align with future UK SRS requirements. SFDR (Sustainable Finance Disclosure Regulation) EU regulation requiring financial market participants to disclose sustainability risks and impacts. In force since 2021, with phased implementation. Full application of Level 2 requirements began in January 2023. CSRD (Corporate Sustainability Reporting Directive) Expands and strengthens sustainability reporting requirements across the EU. Effective from January 1, 2024, for large public-interest companies. In February 2025, the European Commission proposed amendments to limit applicability to firms with over 1,000 employees, potentially reducing the number of companies required to report. These changes are pending approval by the European Parliament and member states. UK SDR (Sustainability Disclosure Requirements) UK framework for sustainability-related disclosures, including investment labeling and marketing rules. The Financial Conduct Authority (FCA) delayed the implementation of naming and marketing rules to April 2, 2025, to allow firms more time to comply. The SDR includes anti-greenwashing rules and introduces four investment labels to help consumers understand the sustainability objectives of investment products.

Conclusion: ESG Reporting as Strategic Resilience

In the UK and Europe, ESG reporting is becoming a strategic tool to drive credibility, investment confidence, and long-term value. Financial institutions that take a forward-looking approach—anchored in robust data, regulatory awareness, and stakeholder engagement—are best positioned to thrive in the transition to a low-carbon, socially responsible economy.

How SALI Can Support You

SALI helps institutions benchmark readiness against leading standards. Book a demo to learn how – sali-ai.com

Subscribe to the SALI Newsletter for monthly insights on disclosure trends, ISSB updates, and policy shifts in Europe. -

EU’s Corporate Sustainability Due Diligence Directive (CSDDD): What You Need to Know

As global sustainability expectations evolve, the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD) is setting a new benchmark for corporate accountability. This landmark legislation goes beyond traditional ESG disclosures—requiring companies to actively prevent, mitigate, and account for human rights and environmental harm throughout their value chains.

Whether you operate in the EU or partner with EU-based companies, understanding the CSDDD is essential to future-proofing your business and aligning with global sustainability norms.

What Is the Corporate Sustainability Due Diligence Directive (CSDDD)?

The Corporate Sustainability Due Diligence Directive, or CSDDD, is a legislative proposal by the European Commission designed to ensure companies take responsibility for the impact of their operations, including subsidiaries and supply chains.

Core Objectives:

- Protect human rights: Safeguard labor rights, prevent child labor, forced labor, and discrimination.

- Preserve the environment: Prevent deforestation, biodiversity loss, pollution, and climate damage.

- Embed sustainability into governance: Require companies to integrate due diligence into their policies, risk management, and oversight structures.

In short, CSDDD shifts sustainability from “voluntary reporting” to legally binding due diligence.

Who Does the CSDDD Apply To?

As of 2024, the CSDDD will apply to companies based on their size and turnover, both within and outside the EU.

In-scope companies include:

EU Companies:

- Group 1: ≥ 1,000 employees and ≥ €450 million turnover worldwide.

- Group 2 (High-risk sectors): Lower thresholds apply for sectors like textiles, agriculture, and mining.

Non-EU Companies:

- Operating in the EU with a net turnover ≥ €450 million within the EU, regardless of whether they have a legal presence there.

This means even companies outside Europe need to comply if they do business in the EU or are part of an EU company’s value chain.

What Are the CSDDD Requirements?

Companies under the CSDDD will be required to:

1. Conduct Due Diligence Across the Value Chain

- Map out and assess human rights and environmental risks across own operations, subsidiaries, and supply chains.

- Engage with stakeholders, including workers, communities, and civil society.

2. Integrate Due Diligence into Company Policies

- Develop a due diligence policy that identifies and addresses risks.

- Regularly update risk assessments and impact evaluations.

3. Prevent and Mitigate Adverse Impacts

- Take appropriate measures to prevent potential harm or mitigate ongoing damage.

- Terminate relationships with suppliers that fail to comply after remediation efforts.

4. Establish a Grievance Mechanism

- Provide accessible channels for affected parties to report issues.

- Collaborate with trade unions, NGOs, and workers’ representatives.

5. Monitor, Track, and Communicate Progress

- Regularly monitor the effectiveness of due diligence actions.

- Publicly disclose due diligence practices and outcomes (closely aligned with CSRD reporting obligations).

6. Link Executive Pay to Sustainability

- Larger companies will need to align directors’ variable remuneration with climate transition plans and sustainability goals.

What Happens If Companies Don’t Comply?

The CSDDD includes real legal consequences:

- Fines and Sanctions: Member States can impose proportionate penalties, including substantial fines based on turnover.

- Civil Liability: Companies may be held legally liable if they fail to prevent harm and victims suffer loss as a result.

In effect, this brings legal accountability to ESG practices, not just reputational risks.

How Is the CSDDD Different from Other Regulations?

Regulation Focus Binding? Value Chain Scope CSRD Disclosure/reporting Yes Limited to operations & upstream CSDDD Due diligence/actions Yes Full value chain, incl. downstream GRI/UNGPs Voluntary frameworks No Full value chain (guiding principles) Unlike CSRD, which focuses on reporting, CSDDD is about action and accountability. It operationalizes the UN Guiding Principles on Business and Human Rights (UNGPs) and the OECD Guidelines for Multinational Enterprises into binding EU law.

Implications for Businesses: What You Should Do Now

Whether or not you fall directly under the directive, the ripple effects will reach most global supply chains. Here’s how to prepare:

Assess Your Exposure

- Are you directly covered under CSDDD?

- Do you supply or partner with EU companies that are?

Map Your Value Chain Risks

- Identify high-risk areas for labor exploitation, environmental degradation, or governance issues.

- Prioritize sectors like textiles, agriculture, extractives, and electronics.

Strengthen Governance and Oversight

- Appoint sustainability leads at board or C-suite level.

- Embed due diligence in enterprise risk management (ERM) systems.

Engage Suppliers and Partners

- Set clear ESG expectations and integrate them into contracts.

- Provide capacity-building or onboarding support for smaller suppliers.

Align with Reporting Standards

- Coordinate CSDDD activities with CSRD, GRI, ISSB, and ESRS frameworks to streamline sustainability reporting and reduce duplication.

Final Thoughts: Why CSDDD Is a Turning Point

The CSDDD marks a paradigm shift in corporate sustainability—from passive reporting to proactive responsibility. It is a powerful step toward a just transition, corporate accountability, and global sustainability standards.

Companies that embrace the directive early will not only reduce legal and reputational risks—they’ll build resilience, trust, and long-term value in a purpose-driven economy.

In the age of global transparency, ethical business is no longer an option—it’s an obligation.

Book a demo: sali-ai.com

-

The Role of Materiality in ESG Reporting: How to Identify What Matters

As the demand for transparency and accountability grows, Environmental, Social, and Governance (ESG) reporting has become a critical part of corporate strategy. However, not all sustainability issues carry the same weight. This is where materiality comes into play — helping businesses identify, prioritize, and report on the issues that matter most to stakeholders and long-term success. In this article, we explain the role of materiality in ESG reporting and how your organization can effectively identify what matters.

What is Materiality in ESG Reporting?

Materiality in ESG reporting refers to the process of determining which environmental, social, and governance issues have the most significant impact on a company’s financial performance, stakeholders, and long-term viability.

There are two main types of materiality:

- Financial Materiality: Focuses on issues that could affect a company’s financial health and shareholder value.

- Impact Materiality: Considers the company’s impact on society and the environment, regardless of financial implications.

The latest frameworks, such as the European Sustainability Reporting Standards (ESRS), adopt a “double materiality” approach that combines both financial and impact materiality.

Why Materiality Matters in ESG Reporting

- Focus and Clarity: Materiality assessments help businesses concentrate resources on the most relevant ESG issues.

- Enhanced Stakeholder Trust: Transparency in selecting and reporting material issues builds credibility with investors, customers, and regulators.

- Regulatory Compliance: Frameworks like the CSRD, GRI, and IFRS Sustainability Disclosure Standards require clear identification of material topics.

- Strategic Decision-Making: Materiality helps integrate ESG priorities into business strategy and risk management.

Steps to Conduct a Materiality Assessment

1. Define Objectives and Scope

Start by clarifying why you’re conducting the assessment. Are you preparing for regulatory reporting, enhancing stakeholder communications, or shaping long-term strategy?

2. Engage Stakeholders

Collect insights from key stakeholders — including investors, employees, customers, regulators, and community representatives — through surveys, interviews, or workshops.

3. Identify Potential ESG Issues

Develop a comprehensive list of ESG topics relevant to your industry, operations, and geographic presence. Leverage sector-specific guidance and resources from GRI, SASB, and ESRS.

4. Prioritize Issues

Analyze the importance of each issue from two perspectives: its impact on stakeholders and its influence on business success. Tools like SALI’s AI-driven materiality mapping platform can simplify this process.

5. Validate and Approve

Review and validate findings with senior management and board members to ensure alignment with corporate strategy.

6. Communicate and Report

Integrate the results of your materiality assessment into ESG reports, sustainability disclosures, and corporate strategy documents.

Best Practices for Materiality in ESG Reporting

- Update regularly: Conduct assessments every 1-2 years or when significant changes occur in the business or external environment.

- Ensure transparency: Disclose the methodology used for materiality assessments in your ESG reports.

- Align with standards: Follow internationally recognized frameworks like GRI, ESRS, and IFRS to meet stakeholder and regulatory expectations.

The Role of Technology in Materiality Assessments

Platforms like SALI (Sustainability Assessment, Reporting, and Learning Intelligence) use AI and advanced analytics to:

- Map material topics against industry benchmarks.

- Visualize double materiality matrices.

- Track evolving stakeholder expectations.

- Generate reports tailored to multiple reporting frameworks.

Conclusion

In a rapidly changing business environment, materiality is the foundation of effective ESG reporting. Identifying and focusing on what matters most empowers companies to make informed decisions, manage risks, and demonstrate accountability.

Need help identifying material ESG issues for your organization? SALI’s AI-powered solutions can guide your materiality assessment process and reporting. Contact us here to learn more.

-

ESRS vs. GRI vs. IFRS: Which Sustainability Reporting Standard Should You Follow?

As sustainability becomes central to business strategy and investor decisions, companies face a critical question: Which sustainability reporting standard should we follow? Among the most prominent frameworks are the European Sustainability Reporting Standards (ESRS), the Global Reporting Initiative (GRI), and the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards. Each serves unique purposes and audiences, making it crucial for businesses to understand their differences and choose the best fit.

What is ESRS?

The European Sustainability Reporting Standards (ESRS) are developed by the European Financial Reporting Advisory Group (EFRAG) under the EU’s Corporate Sustainability Reporting Directive (CSRD). The ESRS provides a mandatory and comprehensive framework for reporting environmental, social, and governance (ESG) metrics. Key features of ESRS include:

- Double materiality: Reporting both the company’s impact on the environment/society and how sustainability issues affect the company.

- Mandatory assurance: Reports must be audited.

- Alignment with EU regulations: Tailored for businesses operating in or trading with the European Union.

What is GRI?

The Global Reporting Initiative (GRI) is the most widely used voluntary sustainability reporting standard globally. Established in 1997, GRI focuses on impact materiality — the company’s impact on the environment and society — and is popular among multinational corporations. Key highlights of GRI include:

- Impact-driven disclosure: Emphasizes environmental, social, and economic impacts.

- Sector-specific standards: Customizable reporting guidelines for different industries.

- Voluntary but globally recognized: Used by companies aiming to communicate transparency to a broad audience.

What is IFRS Sustainability Disclosure Standards?

The IFRS Sustainability Disclosure Standards, developed by the International Sustainability Standards Board (ISSB), focus on providing sustainability-related financial disclosures to investors. IFRS standards are investor-centric and designed for global comparability. Key elements include:

- Financial materiality: Focus on how sustainability risks and opportunities affect enterprise value.

- Consistency and integration with financial reporting: Ideal for investors and financial market participants.

- Global alignment: Designed to work alongside other frameworks and recognized worldwide.

ESRS vs. GRI vs. IFRS: Key Differences

Criteria ESRS GRI IFRS Sustainability Standards Applicability Mandatory for EU large companies under CSRD Voluntary, used globally Voluntary, investor-focused, gaining momentum Materiality Approach Double materiality Impact materiality Financial materiality Focus EU regulatory compliance, comprehensive ESG Transparency on environmental and social impact Investor-focused, financial relevance Audit Requirement Mandatory assurance Not mandatory Strong emphasis on reliability and integration Audience Regulators, investors, stakeholders in the EU Global stakeholders, public accountability Investors, financial market participants How to Choose the Right Sustainability Standard

- Location and Regulatory Requirements: If you operate in the EU or plan to do business there, ESRS compliance is non-negotiable.

- Audience and Objectives:

- Want to communicate impact transparently? GRI is ideal.

- Need to focus on financial implications of ESG risks and opportunities? IFRS Sustainability Standards are a better fit.

- Require broad, comprehensive ESG reporting with regulatory assurance? Go with ESRS.

- Industry Practice: Some industries have established norms, with certain sectors leaning heavily on GRI or aligning with IFRS frameworks.

- Company Size and Structure: Large, publicly traded firms with EU ties should prioritize ESRS. Smaller companies or those focusing on corporate social responsibility might find GRI more practical.

- Integration with Financial Reporting: Companies looking to integrate ESG disclosures directly into financial reporting for investor use may lean toward IFRS.

The Role of Technology in Multi-Framework Reporting

For companies navigating multiple frameworks, digital solutions and AI platforms like SALI (Sustainability Assessment, Reporting, and Learning Intelligence) are game-changers. SALI helps organizations:

- Map and align disclosures across ESRS, GRI, and IFRS.

- Automate data collection and reporting processes.

- Conduct materiality assessments.

- Generate customizable reports for different audiences.

Conclusion

In the evolving world of sustainability reporting, there’s no one-size-fits-all answer. Choosing between ESRS, GRI, and IFRS standards depends on your company’s regulatory obligations, goals, audience, and strategic direction. Often, companies will use a combination of these standards to meet the expectations of regulators, investors, and the public.

Not sure which standard to adopt? SALI’s AI-powered tools and expert guidance can help your business comply with global sustainability frameworks and stay ahead. Contact us today to learn more.

-

CSRD Explained: What It Means for Businesses in 2025

In 2025, the European Union’s Corporate Sustainability Reporting Directive (CSRD) will reshape the landscape of business reporting. Designed to enhance transparency and accountability, the CSRD requires thousands of companies across Europe — and beyond — to disclose detailed information on environmental, social, and governance (ESG) issues. For businesses, understanding what CSRD entails and how to comply is critical.

What is the CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is an EU regulation that builds on and replaces the Non-Financial Reporting Directive (NFRD). It mandates companies to disclose standardized and audited information about their sustainability practices. The directive aims to make ESG reporting more consistent, comparable, and reliable, enabling investors and stakeholders to make informed decisions.

Who Does the CSRD Apply to in 2025?

By 2025, the CSRD will apply to:

- All large companies in the EU (meeting two of the following: more than 250 employees, turnover exceeding €40 million, or total assets over €20 million).

- Listed SMEs (small and medium-sized enterprises), though with more simplified reporting standards and phased timelines.

- Non-EU companies generating more than €150 million in net turnover within the EU and having at least one subsidiary or branch in the EU.

Key Requirements of the CSRD

The CSRD introduces several reporting obligations, including:

- Double materiality: Businesses must assess how sustainability issues affect their operations (financial materiality) and how their activities impact society and the environment (impact materiality).

- Reporting in line with the European Sustainability Reporting Standards (ESRS).

- Mandatory third-party assurance (audit) of sustainability reports.

- Digital tagging of sustainability data to ensure accessibility and comparability.

Why the CSRD Matters for Businesses

The CSRD is more than a regulatory requirement — it’s a business transformation tool. Here’s why it matters:

- Investor Confidence: Transparent and consistent ESG reporting builds trust among investors and financial institutions.

- Risk Management: Identifying ESG risks early helps businesses mitigate potential regulatory and reputational issues.

- Competitive Advantage: Companies leading in sustainability reporting can attract better talent, partners, and customers.

- Global Influence: The CSRD’s impact goes beyond Europe, shaping global sustainability standards.

How Businesses Can Prepare for the CSRD

- Conduct a Gap Analysis: Review current reporting frameworks and identify areas that require alignment with CSRD and ESRS.

- Strengthen Data Collection Systems: Ensure robust mechanisms for gathering and validating ESG data across departments.

- Integrate Sustainability into Corporate Strategy: Align sustainability goals with business objectives and risk management.

- Engage Stakeholders: Involve employees, investors, and suppliers in understanding and contributing to sustainability efforts.

- Work with Experts: Partner with sustainability consultants, legal advisors, and platforms like SALI for guidance and reporting tools.

The Role of Technology and AI in CSRD Compliance

Meeting the CSRD’s complex requirements can be challenging without technology. AI-driven platforms like SALI (Sustainability Assessment, Reporting, and Learning Intelligence) help businesses:

- Automate data collection and reporting.

- Perform materiality assessments.

- Generate reports aligned with ESRS.

- Continuously monitor ESG performance.

Conclusion

In 2025, the CSRD will be a defining framework for business accountability and sustainability. Companies that embrace this change not only ensure compliance but also position themselves for long-term success in a sustainability-driven economy. With the right strategy and tools, businesses can turn CSRD compliance into a competitive edge.

If your business needs support navigating CSRD requirements and automating your ESG reporting, SALI’s AI-driven solutions can help. Contact us today to learn more.