ABERDEEN, SCOTLAND — British engineering firm PowerJacks has joined forces with sustainability compliance platform SALI, in a major step toward digitising its environmental reporting and aligning with international sustainability standards.

The move brings PowerJacks, a global provider of electro-mechanical actuation and lifting solutions onto the AI-powered SALI platform to streamline sustainability data management, reduce compliance risk and reinforce environmental accountability. With the partnership now in place, PowerJacks has begun its formal onboarding with SALI — integrating systems, training staff, and deploying customised sustainability modules to ensure a seamless transition.

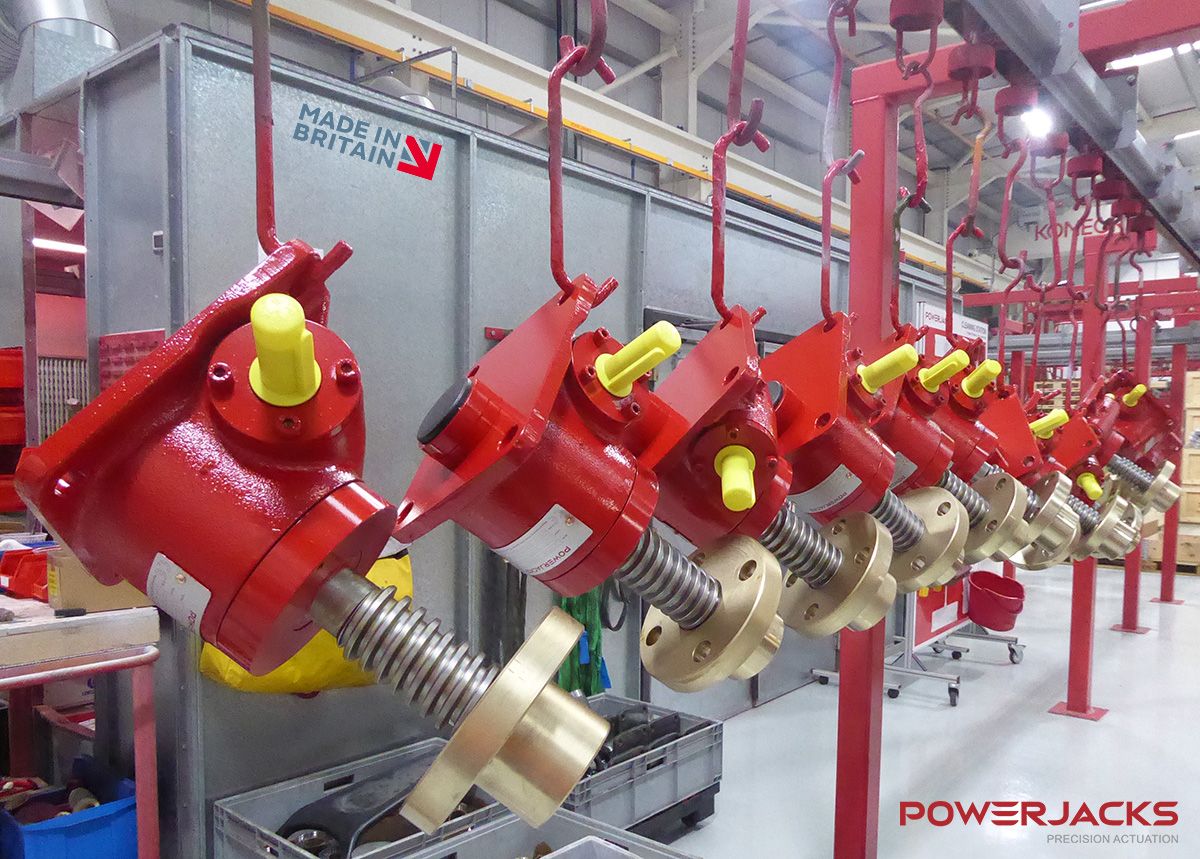

Founded in Aberdeenshire and operating in more than 80 countries, PowerJacks has long been recognised for its precision-engineered products used in sectors ranging from energy to defence. Now, the company is expanding its focus beyond mechanical innovation to include measurable sustainability performance.

The SALI platform, known for its AI-driven compliance assessments and evidence-backed sustainability reporting, enables organisations to meet rapidly evolving regulations such as the Corporate Sustainability Reporting Directive (CSRD), GRI, ISSB, and UN SDGs. With tailored industry modules, SALI validates uploaded documents, scores their quality and generates improvement insights in real time.

Strategic Shift to Digital Assurance

PowerJacks’ integration with SALI allows for automated tracking of key sustainability metrics, including energy usage, waste management, air emissions, and circularity. The company will also benefit from AI-generated scenario modelling and lifecycle assessments, ensuring that operational efficiency is matched by environmental foresight.

The partnership is especially notable given PowerJacks’ deep industrial footprint and long-standing reputation for engineering reliability. With over 60 skilled employees and five core product categories, from screw jacks to jacking systems, the company’s pivot towards ESG alignment signals a broader industry shift.

Part of a Growing Trend

PowerJacks joins a growing list of industrial and manufacturing companies choosing SALI to help them bridge the gap between technical operations and sustainability expectations.

SALI’s framework is designed to adapt across business sizes and sectors, beginning with local codes of practice and scaling up to international reporting frameworks. The platform provides full audit trails, document-backed evidence and sector-specific benchmarks, helping organisations demonstrate true compliance rather than self-declared claims.

“As pressure mounts from regulators, investors, and stakeholders alike, this level of transparent and verifiable reporting has become essential, instead of optional. I applaud PowerJacks’ commitment to quality, and this is reflected in how they are managing their environmental impact,” said SALI’s Chief Executive Officer, Dr. Eberechi Weli.

Building the Future with Evidence

PowerJacks’ decision to partner with SALI reflects a growing corporate awareness that sustainability is a measurable standard of business performance.

The move is expected to enhance stakeholder confidence, reduce operational overhead tied to manual reporting, and position PowerJacks as a frontrunner in sustainable industrial practices.